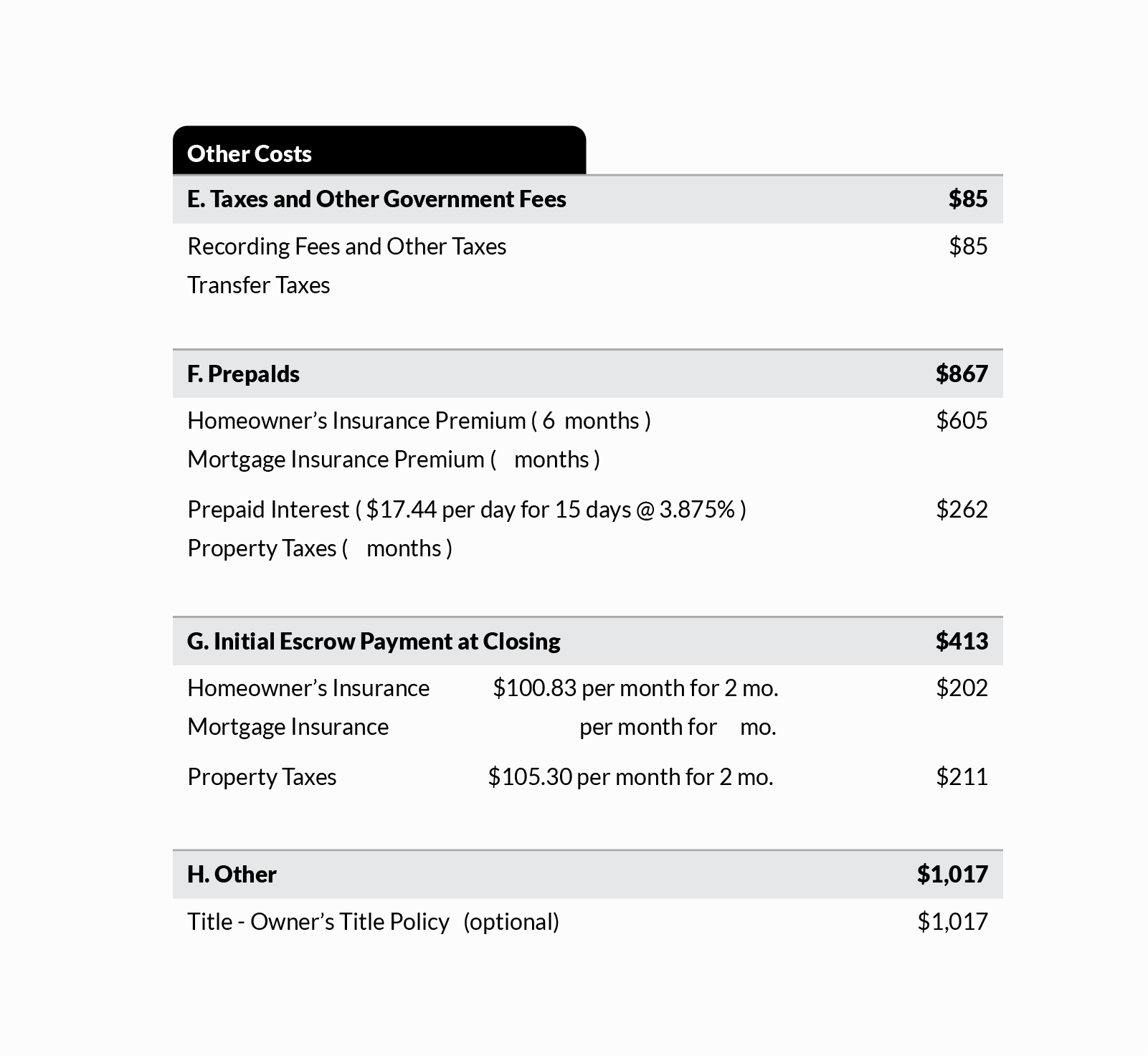

refinance closing costs transfer taxes

Many states charge a feetax when a home is. Ad Understand Closing Cost Fees.

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

But they can run between 2 and 6 of the total amount borrowed.

. You closing costs are not tax deductible if they are fees. State laws usually describe transfer tax as a set. Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands.

In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. Comparing lenders has never been easier.

Ad Compare top lenders in 1 place with LendingTree. These are the only costs you should have. Your lender does not know what they are doing.

North Carolina 1000. Total transfer tax. No closing costs including the below are not tax deductible but may increase the cost basis of your home which may benefit you in the event of sale.

Although there are some recognized loopholesways to get a tax-deductible status on various costs of closing on your housethere are still many costs that are strictly. Average refinancing closing costs are 5000 according to Freddie Mac. Take a look in the AssetsDepreciation section and you should see an entry there for those amortized costs.

If those costs are not. Call us for a quote 2675144630 x1. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing.

Talk To An Expert And Learn More. State Transfer Tax is 05 of transaction amount for all counties. Talk To An Expert And Learn More.

State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of. 2400 12 680 034 None. When the same owners retain the property and simply.

Many other settlement fees and closing costs for buying the property become additions to your basis in the property and part of your depreciation deduction including. Does a lender charge deed transfer taxes in a refinance transaction. Note that transfer tax rates are often described in terms of the amount of tax charged per 500.

For example if you spent 15000 on closing costs for a 15-year refinance youd deduct 1000 a year until your loan matures. For example in Michigan. Remember that tax laws can change on a year-to.

New York 2000. Ad Understand Closing Cost Fees. Special Offers Just a Click Away.

Comparing lenders has never been easier. That means youd likely pay. Does not apply to refis just purchased in PA.

Ad Compare top lenders in 1 place with LendingTree. Generally transfer taxes are paid when property is transferred between two parties and a. Ad Compare the Best Refinance Mortgage Lender that Suits Your Needs with No Closing Costs.

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

The Complete Guide To Closing Costs In Nyc Hauseit

What Are Real Estate Transfer Taxes Forbes Advisor

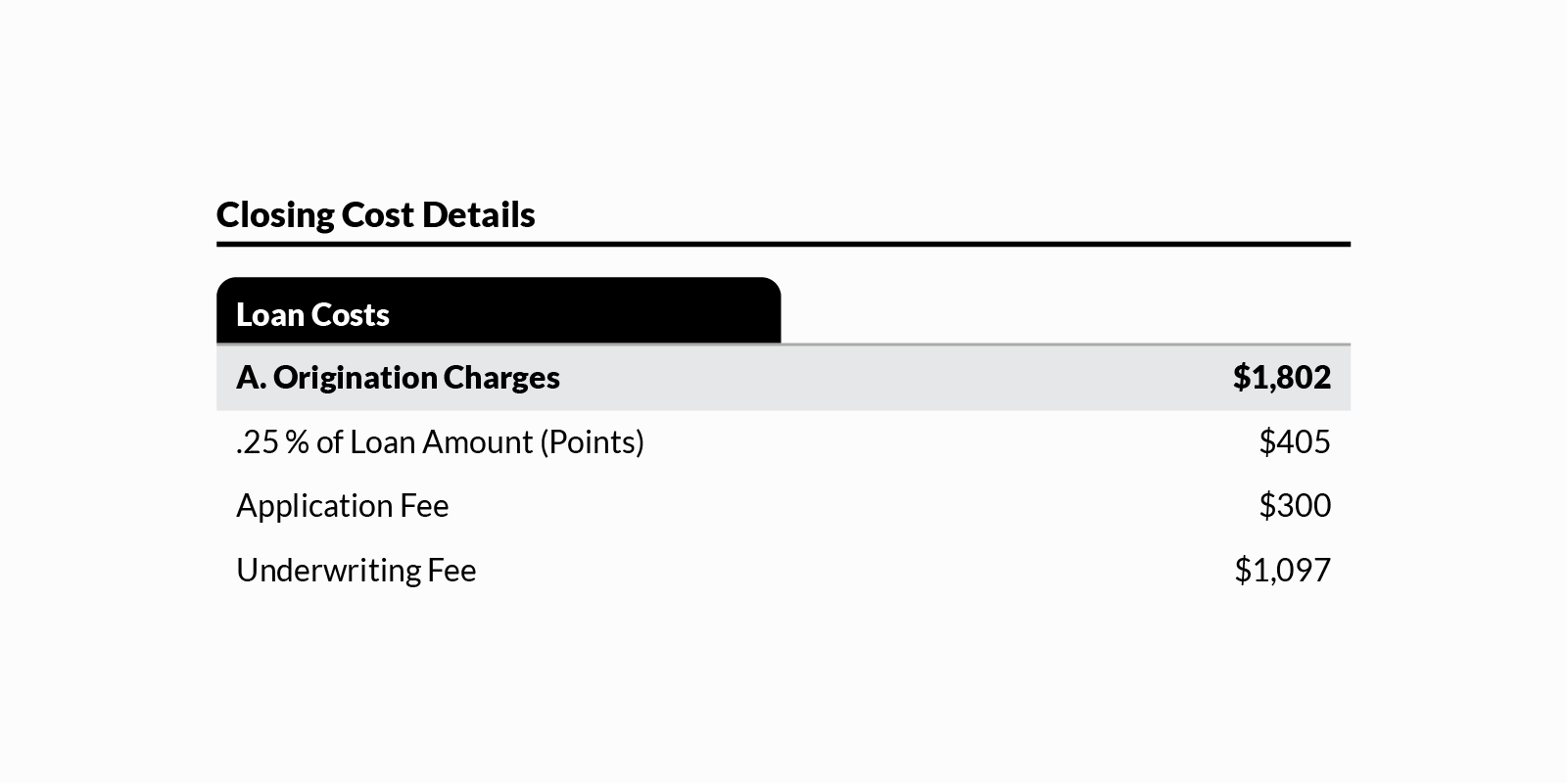

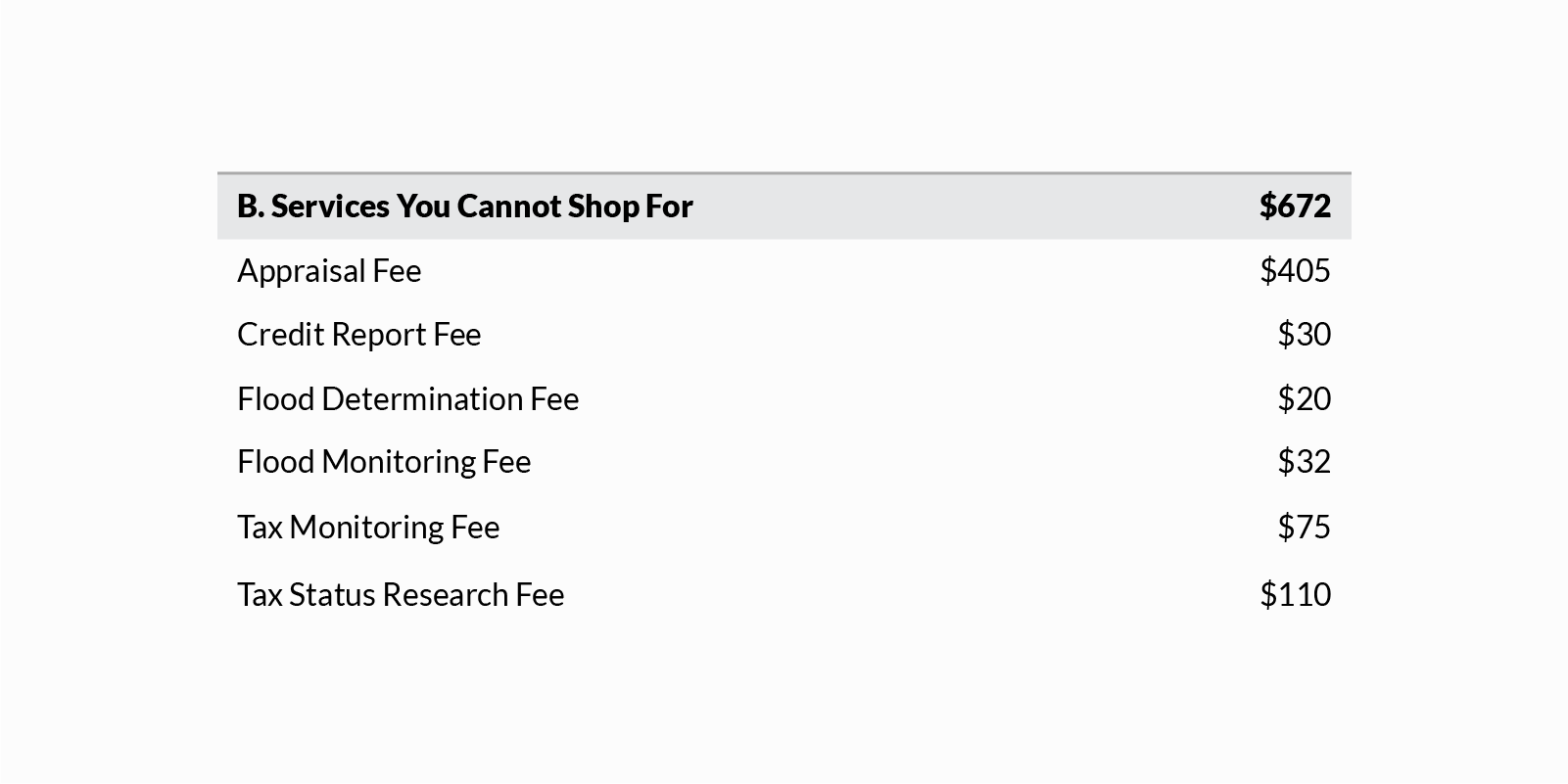

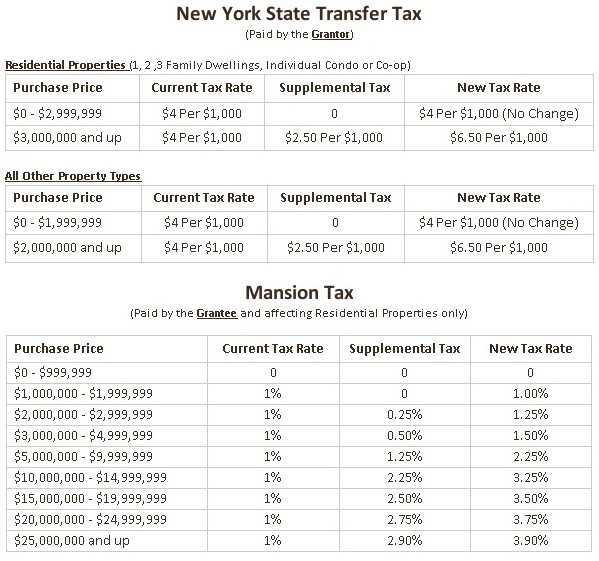

Understanding Mortgage Closing Costs Lendingtree

Closing Costs When Paying All Cash For A Home Financial Samurai

What Is A Loan Estimate How To Read And What To Look For

Closing Cost Estimator Shop 54 Off Www Pegasusaerogroup Com

What Are Real Estate Closing Costs And How Much Will You Pay Ap Fredericknewspost Com

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Understanding Mortgage Closing Costs Lendingtree

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Reducing Refinancing Expenses The New York Times

Understanding Mortgage Closing Costs Lendingtree

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc